Before you jump into the list, it’s worth remembering that the “best ad network” isn’t the one with the loudest marketing or the prettiest dashboard. What really matters in 2026 is how well a platform fits your goals, your vertical, your GEOs, and the way you run campaigns.

The landscape has become tougher: competition is higher, formats have shifted, and expectations around traffic quality are much stricter than they used to be.

That’s why selecting the right platform requires looking at five key factors.

Push notifications, in‑page formats, banners, video ads, domain traffic — every network has its strengths.

Some platforms are perfect for pop traffic, others excel in video formats, and some are built specifically for mobile subscriptions or in‑app monetization.

If your focus is Tier‑1 traffic, you’ll need networks with premium placements and solid filtering. If you’re aiming at fast‑growing regions like India, Egypt, Algeria, or Iraq, you’ll get better results from platforms built to handle large volumes at lower entry costs.

Gambling, dating, utilities, e‑commerce, antivirus, sweepstakes — each vertical performs best with specific traffic sources.

Choosing the wrong network for your vertical can kill performance even if the traffic volume is high.

Some advertisers want full manual control.

Others prefer AI‑driven optimization, automated rules, and smart bidding systems that adjust campaigns in real time.

In 2026, this is absolutely critical.

Networks that don’t invest in filtering and fraud prevention simply don’t survive.

Clean traffic = stable conversions = predictable scaling.

👉 Want to scale smarter, not harder? Grow your campaigns without losing ROI

MyBid works with 200+ GEOs, including complex and fast‑growing markets where many competitors struggle to maintain traffic quality.

Its filtering algorithms are updated regularly, RTB bidding is stable, and the variety of formats covers everything from push notifications to video ads.

For advertisers, MyBid offers a low entry threshold and fast campaign setup.

For publishers, it provides strong monetization of search and organic traffic, high rates in top GEOs, and convenient management through a single integration.

MyBid remains one of the most advanced and fast‑evolving networks in 2026 — not because of hype, but because it consistently improves its technology and performance.

PropellerAds has been a major player for years, and in 2026 it continues to deliver stable performance.

The network focuses heavily on traffic quality and automation, which is especially important for verticals like dating, utilities, sweepstakes, and mobile apps.

It’s a great choice for advertisers who need large volumes with minimal risk of low‑quality traffic.

ClickAdilla has become one of the most flexible platforms in 2026: pop traffic, push notifications, banners, in‑app ads, native formats, and video — all available in one dashboard.

The network is expanding rapidly, adding new tools and supporting rare GEOs.

It performs well in e‑commerce, dating, subscription funnels, and mobile verticals.

Zeropark remains one of the most recognizable networks in the industry.

Its main strength is domain redirect traffic and CPV bidding, which allows advertisers to run precise tests with minimal budgets.

A great fit for media buyers who prefer granular optimization and manual control.

RichAds is all about scale.

If you need massive traffic volumes, dozens of GEOs, and advanced optimization features, this network is a strong choice.

It performs especially well in gambling, betting, dating, and utilities — verticals where automation and traffic diversity matter.

Adsterra remains one of the most stable multi‑format networks in 2026.

It doesn’t rely on loud marketing — instead, it consistently delivers quality and reliability.

The platform supports in‑page ads, banners, native formats, and social bar placements.

The dashboard is intuitive, reporting is detailed, and integrations with trackers are seamless.

Publishers appreciate Adsterra for stable payouts and predictable performance.

Advertisers value it as a safe, scalable platform without unnecessary risks.

👉 Struggling to read your stats the right way? Break down affiliate analytics like a pro

TrafficStars continues to strengthen its position in niches where video formats dominate.

The network actively works with video pre‑rolls, sliders, interstitials, and classic pop formats.

Its key advantage is automation: the platform reallocates traffic, disables weak sources, and adjusts bids intelligently.

TrafficStars performs especially well in adult, dating, and utilities — verticals where video creatives deliver high CTR and fast user engagement.

HilltopAds has invested heavily in anti‑fraud technologies over the past few years, and in 2026 the difference is noticeable.

It has become one of the most reliable options for advertisers tired of low‑quality or bot‑generated traffic.

HilltopAds performs especially well in verticals where traffic cleanliness is critical: finance, antivirus, utilities, and dating.

The dashboard is intuitive, GEO coverage is broad, and the filtering system is precise without over‑blocking.

Clickadu remains one of the most predictable and consistent networks in its niche.

It doesn’t try to be a universal platform — instead, it focuses on what it does best: mobile traffic and pop formats.

The network performs well in Tier‑2 and Tier‑3 regions, where pop traffic still delivers strong volumes and conversions.

The interface has been updated, filtering has improved, and there’s enough traffic to scale campaigns effectively.

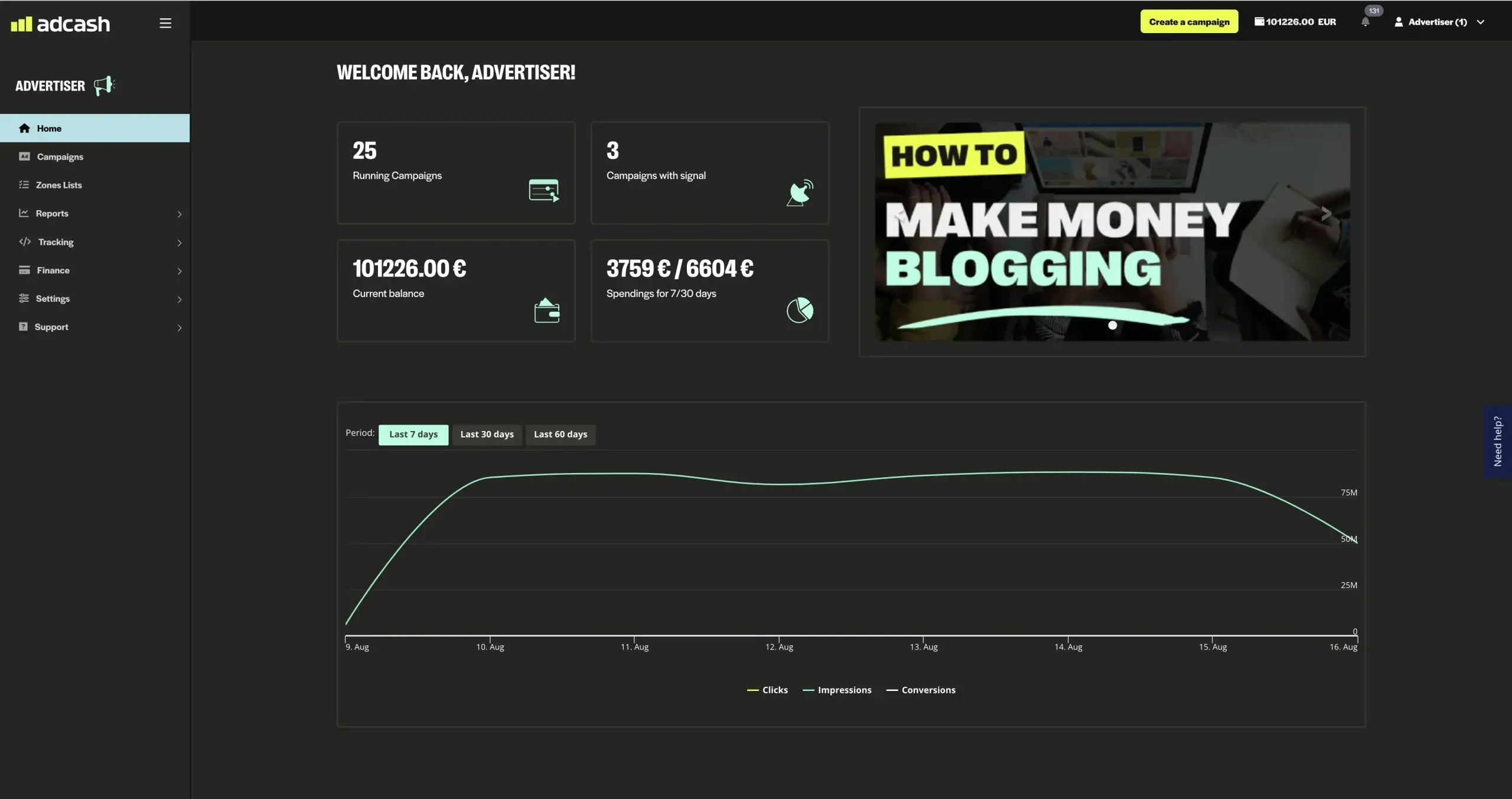

AdCash is known for its global reach and highly customizable targeting options.

In 2026, it continues to offer a wide range of formats and GEO‑level bid adjustments, allowing advertisers to fine‑tune performance across multiple regions.

It’s a strong choice for global campaigns that require rapid testing and the ability to switch GEOs on the fly.

Advertisers choose AdCash for its stability, predictability, and consistent traffic quality.

ROIAds has become one of the most notable platforms for advertisers who prefer automated optimization.

Its algorithms genuinely help maintain target CPA levels rather than simply claiming to.

The network works actively with pop and push formats and provides strong volumes in fast‑growing regions such as Southeast Asia, the Middle East, and parts of Latin America.

ROIAds performs especially well in verticals where stability and scalability matter: iGaming, betting, antivirus, subscriptions, and dating.

ExoClick remains a giant in 2026, especially in niches where video formats dominate.

It’s one of the most technologically advanced networks, capable of handling massive volumes while maintaining quality.

Its strengths include video pre‑rolls, interactive formats, and native video widgets.

ExoClick is widely used in adult, dating, subscription funnels, and utilities — verticals where video creatives deliver high CTR and fast user engagement.

👉 Running dating offers? Don’t waste traffic. Choose the right sources and scale efficiently

PopCash doesn’t try to be a universal platform.

It focuses on one thing — pop traffic — and does it consistently well.

In 2026, PopCash remains one of the most predictable sources of affordable traffic.

It’s a great option for testing, beginners, and verticals where volume matters more than premium quality.

TrafficShop is a practical choice for advertisers who want straightforward traffic without unnecessary complexity.

It offers enough formats, plenty of GEOs, and a simple campaign setup process.

The network performs well in dating, e‑commerce, and utilities — verticals where volume and stability are more important than advanced targeting features.

UngAds is often chosen by beginners or advertisers testing new offers.

It has a low entry threshold, a simple interface, and inexpensive traffic.

This isn’t a platform for deep optimization — it’s built for quick tests and straightforward campaign launches.

If you need to validate a funnel, check GEO performance, or run low‑risk experiments, UngAds is a practical option.

AdMaven remains one of the most recognizable platforms for pop, push, and interstitial traffic.

It doesn’t aim to be a universal solution — instead, it excels in formats that deliver fast results.

Its main strength is aggressive optimization: the platform quickly reallocates traffic, disables weak sources, and helps maintain stable CTR.

This is especially valuable in verticals like dating, sweepstakes, e‑commerce, and mobile subscriptions.

If you need traffic that can “move” a campaign quickly, AdMaven is a strong choice.

EZmob continues to expand its mobile offering in 2026.

The network focuses on in‑app traffic, mobile banners, pops, and push notifications.

Its biggest advantage is accessibility: low bids, large volumes, and fast campaign setup.

This makes EZmob ideal for mobile utilities, subscriptions, sweepstakes, and dating — especially when your audience is primarily on mobile devices.

If your funnel is mobile‑first, EZmob is one of the most logical platforms to test.

JuicyAds remains one of the most reliable sources of adult traffic, including dating and subscription funnels.

The network doesn’t try to cover the entire market — it focuses on its niche and does it confidently.

If you need stable, predictable adult traffic with consistent volumes, JuicyAds is a dependable option.

👉 Losing money on bad offer choices? Avoid the 10 rookie mistakes that drain your budget:

AdOperator is often chosen for its accessibility.

It offers low bids, large volumes, and a simple interface.

The network is well‑suited for beginners, testing phases, Tier‑3 GEOs, and verticals where volume matters more than premium quality.

AdOperator doesn’t offer advanced optimization tools, but it provides a steady flow of impressions — and sometimes that’s exactly what a campaign needs.

Kadam remains one of the most technologically advanced platforms in its region.

It focuses on analytics and detailed targeting, allowing advertisers to manage campaigns with precision.

The network supports click‑unders, push notifications, banners, native formats, and more.

Kadam performs especially well in verticals where accuracy matters: finance, e‑commerce, utilities, antivirus.

If you enjoy “working with the numbers” and prefer manual bid control, Kadam is one of the most convenient platforms.

Adlook specializes in video and display advertising with CPM billing.

It operates through programmatic auctions, connects to dozens of DSPs, and ensures high fill rates through competitive bidding.

It’s a strong choice for publishers and advertisers who prioritize high‑quality creatives, stable payouts, and modern ad tech infrastructure.

RTBSape operates on a full RTB model, selling impressions through real‑time auctions.

The platform connects to major agencies, DSPs, and OpenRTB networks, offering a wide range of formats — from video ads to mobile banners.

It’s a strong choice for publishers and advertisers who need high fill rates, flexible monetization, and access to diverse demand partners.

Buzzoola is a major video advertising platform working with in‑feed and native placements.

It reaches a massive audience, supports advanced targeting, and prioritizes brand safety through contextual analysis and fraud prevention.

The network is ideal for advertisers who want high‑quality video inventory without aggressive or intrusive formats.

👉 Looking for fresh traffic angles in iGaming? See which sources actually convert

The ad network landscape has become more complex — but also more full of opportunity.

There is no universal platform that fits every advertiser or every vertical.

The right choice depends entirely on your goals, GEOs, traffic type, and budget.

Here are the key principles to keep in mind:

Choose networks known for strong filtering and clean inventory:

MyBid, HilltopAds, AdCash.

Look at platforms with advanced algorithms:

ROIAds, MyBid, TrafficStars.

Focus on networks with strong in‑app and mobile formats:

EZmob, ClickAdilla.

Choose networks that specialize in this niche:

JuicyAds, TrafficStars, ExoClick.

Go for networks with global reach and high scalability:

RichAds, PropellerAds, ExoClick.

Pick networks with low entry thresholds and affordable traffic:

UngAds, PopCash, AdOperator.