In 2025, media buyers were struggling with TikTok bans, Meta’s instability, and rising Google Ads costs. By contrast, 2026 demands a fresh look at channels that were unfairly overlooked. While most buyers crowd into overheated niches, Snapchat remains a “quiet harbor” with a massive, solvent audience and surprisingly low competition. It’s one of the few stable sources that not only preserved but expanded its position, especially across Tier‑1 and Tier‑2 regions.

Why is Snapchat — still perceived by many as an app for disappearing photos — becoming a must‑have tool for media buyers in 2026? The answer is simple: platform evolution and the unique nature of its audience. While other social networks try to copy each other’s formats, Snapchat continues to double down on privacy, fast content, and deep integration into the daily lives of Gen Y and Gen Z.

Within the media buying ecosystem, Snapchat plays the role of a “hidden champion.” It’s not just a channel for topping up traffic — it’s a full‑fledged source capable of delivering both cheap testing traffic and stable volumes in high‑payout geos.

Working with Snapchat in 2026 is not about “launch and forget.” It’s about understanding audience behavior patterns, fine‑tuning creatives, and — of course — choosing the right offer and a reliable affiliate network. You gain access to an audience that spends, trusts, and converts.

Before we jump into the main guide, we recommend connecting to MyBid, our fully managed multi‑format advertising network built for teams that want predictable performance and fast scaling. MyBid gives advertisers access to competitive CPC rates starting from $0.00003, high‑converting traffic across 200+ GEOs, instant moderation, direct traffic sources, built‑in fraud protection, free creatives, and over 5 billion daily impressions. You also get real‑time bidding, safe monetization through Google and Yandex, 24/7 personal support, and convenient payment options including Wire Transfer, Paxum, Capitalist, Visa, and Mastercard.

Publishers will find MyBid just as valuable: high CPC rates from $0.015, access to premium GEOs like the US, Canada, the UK, Germany, and Australia, safe monetization for Google and Yandex traffic, flexible partnership models (Prepayment, Fixed Rate, Revshare, CPC, CPM), and fast payouts through Bitcoin, Wire Transfer, Paxum, Capitalist, WebMoney, Tether, and PayPal. With advanced analytics, UTM tracking, Trafficback tools, and round‑the‑clock support, MyBid helps publishers increase ROI and monetize every visitor with maximum efficiency.

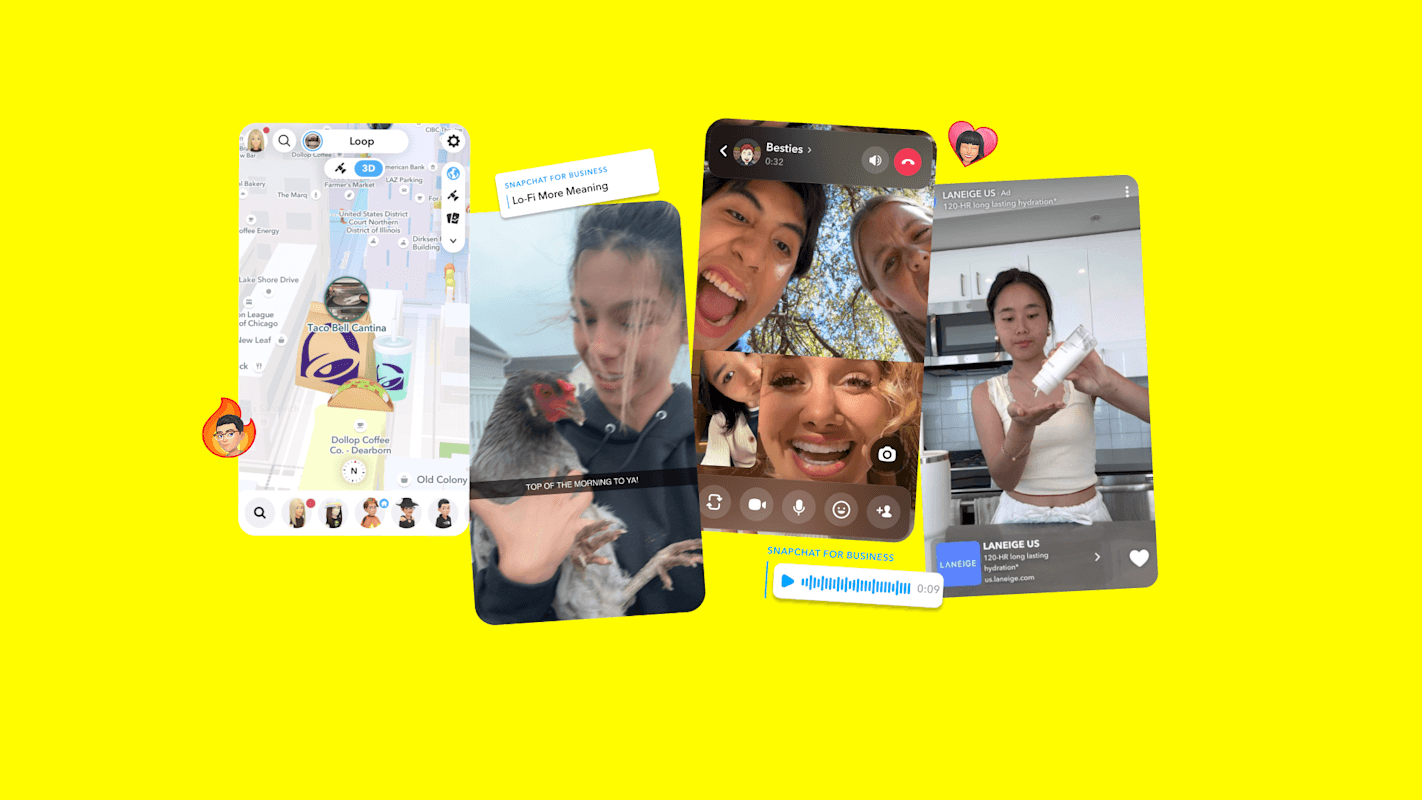

Snapchat stopped being just a messenger for disappearing messages long ago. Since 2011, the platform has evolved into a full media ecosystem with over 700 million monthly active users. In 2026, it’s the fifth most popular social network in the world, outperforming many platforms in engagement.

This evolution created several key product elements every media buyer must understand:

The core feature where users share moments from their lives. This is where most attention — and ad inventory — is concentrated.

Snapchat’s TikTok‑like feed of short vertical videos curated by algorithms. A great place for viral reach from a fresh account.

A section with content from major media outlets, brands, and influencers. This is where more “polished” ad formats like Commercials appear.

The platform’s signature feature. Interactive masks and effects that users love applying to photos and videos. For media buyers, this is a powerful tool for virality and engagement.

The foundation of communication. High trust levels between users.

People move through Snapchat fast. The whole experience is built around quick vertical content, personal chats, and an endless stream of UGC. Most users open the app dozens of times throughout the day — often 30–40 sessions, adding up to 1.5–2 hours of screen time. They watch Stories with sound on, swipe without hesitation, and interact far more actively than on most other platforms. For offers where the decision is made in seconds, this environment works surprisingly well.

From a geographic standpoint, Snapchat’s strongest foothold is still in the English‑speaking world and mature markets: the US (100M+ users), Canada, the UK, France, and Germany. India has exploded past 200M users, and the Middle East continues to grow at a rapid pace. This mix gives buyers room to work both with high‑payout Tier‑1 campaigns and with scalable Tier‑2/Tier‑3 volumes.

Russia’s audience — roughly 7 million people — sits on the sidelines of the global picture. For CIS teams focused on “burzh,” this is actually an advantage: fewer local competitors means more breathing room.

A clear understanding of who uses Snapchat is the foundation of any successful campaign. The platform’s audience behaves differently from Instagram or TikTok, and that difference matters.

Age: More than 60% of users are under 24. The core group is 18–34 — Gen Z and young millennials who study, date, build careers, and spend money freely.

Gender: The split is almost even: 51% men, 49% women.

Income: Despite the stereotype of “broke students,” a large share of Snapchat’s audience — especially in the US and Europe — earns $25,000–$74,000 per year.

The strongest markets are the US, Canada, the UK, France, Germany, and the MENA region — all excellent for high‑quality leads and strong payouts.

How they watch Stories: Quickly, but not mindlessly. Users choose whose Stories to open, which creates a warmer, more intentional audience for Story‑based ads.

How they react to ads: Native, UGC‑style creatives perform best. Anything that looks too polished or “salesy” gets swiped away instantly. Users trust content that feels like it came from real people inside the platform.

What builds trust: Shaky camera, real faces, casual speech, honest emotion. Imperfect videos shot “on the go” consistently outperform studio‑grade production.

Instagram is a curated storefront — polished photos, public personas, social competition. Snapchat is closer to a private conversation — spontaneous, unfiltered, and temporary. Because of this, Snapchat users are more open to narrative‑driven ads that feel like a friend’s Story.

TikTok is entertainment first — an endless algorithmic feed. Snapchat is communication first — built around close circles and personal interactions. On TikTok, new accounts struggle without boosting. On Snapchat, a Spotlight video can go viral from zero — a huge advantage for UBT‑style strategies.

Snapchat has long moved past the idea of being “the app for disappearing photos.” Since 2011, it has grown into a full media ecosystem with its own culture and user behavior. By 2026, it ranks as the fifth largest social platform, with 700M+ monthly active users and engagement levels many competitors can’t match.

This evolution created several core features every media buyer must understand:

The main stage of Snapchat. Users share real‑time moments here, and this is where most ad inventory lives. Stories are viewed quickly but deliberately — ideal for performance creatives.

Snapchat’s version of TikTok’s feed: short vertical videos pushed by algorithms. New accounts can go viral here without any boosting, which is rare on other platforms.

A curated space for publishers, brands, and influencers. This is where more polished formats like Commercials appear — structured, editorial, and premium.

Snapchat’s signature feature. Masks, effects, and interactive filters are deeply woven into user behavior. For advertisers, AR can generate viral UGC and strong engagement, even if it’s not always tied directly to CPA.

The backbone of the platform. Communication here feels personal and trusted, shaping the overall tone of Snapchat as more intimate and less performative than other networks.

Snapchat is built for speed and spontaneity. Users jump in and out constantly, watch Stories with sound, swipe aggressively, and interact more than on most platforms. For performance marketing, this means:

This behavior is exactly what makes Snapchat so valuable for media buyers.

Snapchat’s strongest markets include:

This mix supports both high‑payout Tier‑1 campaigns and scalable Tier‑2/Tier‑3 volumes.

Russia’s ~7M users remain outside the main competitive field, which benefits CIS teams working internationally.

Instagram is overheated. Buyers from all over the world pour traffic into Meta’s ecosystem, driving prices up. According to available data, the average CPM on Facebook/Instagram is $12–18, while Snapchat typically sits around $3–6.

That’s a massive difference.

Snapchat uses an auction system where high engagement (CTR) naturally lowers your cost per click. Fewer advertisers means cheaper traffic and a higher chance your ad will actually be seen.

What works on Instagram — glossy visuals, polished photos, staged videos — often fails on Snapchat.

Snapchat speaks the language of Gen Z:

UGC rules the platform. Your creative should look like it was filmed by a regular person for their friends — not by a brand’s marketing department. Using filters and AR lenses is not only acceptable but often expected.

Snapchat does have moderation, and it’s getting stricter. But compared to Meta’s hyper‑sensitive algorithms — which can ban accounts for the slightest hint of a “gray” vertical — Snapchat remains more tolerant.

Here, creatives for dating (without explicit 18+), gambling (with licensing or proper masking), and nutraceuticals pass more easily. “Black‑hat” schemes won’t work, but the “gray zone” has more breathing room.

Important nuance: moderation is two‑step (automatic + manual), and user complaints can quickly lead to bans.

Snapchat offers its own tracking tools:

These allow you to track events, optimize for conversions, and build audiences.

Snapchat’s attribution system has its own specifics, but the platform provides extremely detailed analytics in the Analyze section. You can see not just age and gender, but:

Meta doesn’t offer this level of granularity.

Snapchat Ads is the advertising platform available through the Snapchat Ads Manager (business.snapchat.com). The interface is intuitive, but — like any professional media buying tool — it requires attention to detail.

The advertising account consists of several key sections:

Where campaigns are created and objectives are selected.

A storage hub for all your “assets”:

A section for creating and storing AR lenses and filters — a powerful but still underused tool.

The “holy of holies.”

This is where all audience research lives: reach, demographics, interests, behaviors.

Studying this section is mandatory before launching any campaign.

Tools for developers, mostly for AR creation.

Billing information, company details, and account settings.

In Snapchat Ads Manager, you can choose the objective that best matches your goal:

To drive users to a website or landing page.

For promoting mobile apps and games.

To track and optimize for specific actions on your website (purchases, registrations, leads) using Snap Pixel.

For maximum reach and brand visibility.

Snapchat uses a familiar three‑level structure:

Defines the overall objective and budget.

Defines:

The creative itself (video/image + text + CTA).

Snap Pixel is Snapchat’s equivalent of the Facebook Pixel.

It’s installed on your landing page or website and allows you to:

For mobile apps, Snapchat uses an SDK.

Installing the pixel is mandatory for any serious performance work.

You can run ads from a personal account, but a business profile is required for advertising.

For large volumes, there are agency accounts and partner access options, which often provide:

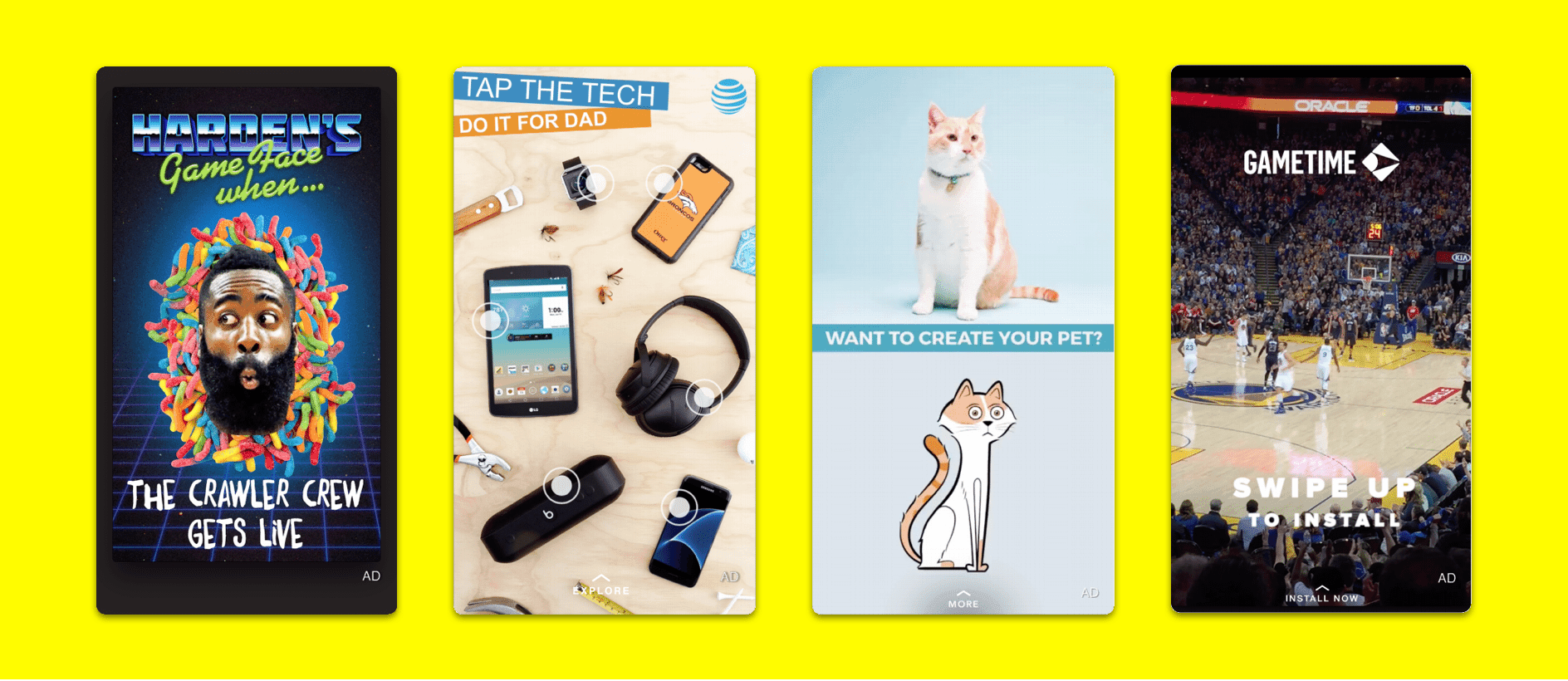

Snapchat offers six main formats. Media buyers typically use the first four, but it’s important to know all of them.

Vertical photos or videos (9:16, 1080×1920) shown between user Stories or in Spotlight.

Video length: 3–180 seconds (optimal: 10–15 seconds).

Best practices:

Use cases:

Traffic, app installs, simple offers.

Ads that appear in the Story carousel.

They consist of a cover (image + headline) and a sequence of Story‑style ads.

Storytelling specifics:

The user chooses whether to tap your Story.

If they do, you can deliver a longer narrative.

Use cases:

Complex offers, funnels requiring explanation, branding.

A “storefront” format.

A short promo video with a grid of four clickable products underneath.

Each product leads to its own page.

Use cases:

E‑commerce, especially when integrated with Amazon for one‑click purchases.

Non‑skippable ads shown in Discover content.

Length: 6 seconds to 3 minutes.

The first 6 seconds cannot be skipped.

Use cases:

Maximum reach, guaranteed message delivery, simple performance offers.

Branded masks and effects users can apply to their photos and videos.

The most engaging and viral format on the platform.

Performance angle:

Hard to monetize directly via CPA, but excellent for:

Automated ads that pull products from your Snap Catalog and show users items they viewed or may like.

Use cases:

Retargeting and scaling e‑commerce sales.

Requires catalog integration and a properly configured pixel.

Cold traffic, simple goals (traffic, installs):

Warm traffic, complex products:

E‑commerce:

Virality, brand presence:

You’ve studied the audience, set up your account, created strong creatives, and launched traffic. But where should that traffic go to generate maximum profit? Direct advertising is for brands promoting their own products. Media buyers work through affiliate networks (CPA networks), which aggregate offers from advertisers and provide the tools needed to earn efficiently.

A strong affiliate network gives you:

The network provides dozens or hundreds of offers across different verticals and geos, with contracts already negotiated.

You don’t need to search for advertisers, negotiate payouts, or integrate tracking manually — the network handles all of that.

A reputable network protects you from non‑payments and fraud on the advertiser’s side.

Networks offer tracking links, smartlinks, postbacks, real‑time statistics, and other optimization tools.

Not all networks are equally suitable for Snapchat. When choosing one, pay attention to:

Ask your manager whether they have offers specifically approved for Snapchat.

Some networks call them Snapchat‑offers or whitelisted offers.

Your network should work with the niches you plan to run:

The network should support the geos you want to target:

Tier‑1, Tier‑2, MENA, India, etc.

Look for:

Fast communication with your manager, quick issue resolution, and transparent reporting are essential.

Here we’ve collected answers to the most common questions media buyers face when working with Snapchat.

1. How much budget is needed for testing? For a proper test of a bundle (geo + creative), allocate at least $300–500 per ad set. Snapchat’s algorithms need time to learn, so don’t jump to conclusions after the first $50. The recommended test period is 2–3 days with a daily budget of $50+.

2. Can beginners enter the platform? Yes. Snapchat is an excellent entry point for beginners. Lower competition and cheaper traffic make it easier to find profitable bundles even with small budgets. Start with simple “white” offers (mobile games, dating) and test 2–3 geos.

3. Which geos are best for starting out? Tier‑2 European countries (Poland, Czech Republic, Greece) or English‑speaking Tier‑2 markets (Australia, Canada). Competition and creative requirements are lower than in the US, while payouts remain attractive.

4. How fast is moderation? Usually a few hours to 24 hours. If a campaign is stuck longer, contact support. New accounts may face stricter and longer moderation.

5. What to do if your account is blocked? First — don’t panic and don’t create a new account with the same data. Identify the reason (usually explained in an email). If it’s a mistake, appeal via support. If it’s a violation, prepare a new account with fresh proxies, a new anti‑detect browser, and new creatives.

6. How often should creatives be updated? Snapchat’s audience consumes content very quickly. Update your creative pool every 3–5 days. If CTR drops below 0.5%, it’s time to change. Always keep 5–10 new ideas ready.

7. Can TikTok/Instagram creatives be reused? Yes, but carefully. What works on TikTok may not work on Snapchat. Adapt them: make them more “alive,” add AR elements, shorten them to match Snapchat’s fast pace. Simple copy‑paste often fails.

8. How to combine Snapchat with other sources? Snapchat works both independently and in synergy. For example, you can collect cheap traffic from Snapchat (especially UBT), warm it up, and retarget in Facebook or Google. But this requires a unified analytics system (tracker).

9. How to work with an affiliate program if Snapchat is the main source? Very simple. Register, tell your manager Snapchat is your main source. They’ll recommend offers that convert best on this platform and provide optimized links. All stats will be available in your dashboard.

10. Which verticals should be avoided?

We’ve covered a long journey: from Snapchat’s demographics to campaign setup and affiliate network selection. Now it’s time to answer the main question: Is Snapchat worth it in 2026?

Snapchat’s potential for traffic arbitrage is enormous — and underestimated. While major platforms suffocate under competition and stricter moderation, Snapchat offers a unique mix:

Of course, it’s not a “money button.” Snapchat requires respect for its audience and fluency in its language. But if you invest in creatives and testing, the payoff will come.