Affiliate marketing is growing rapidly, and choosing the right GEO is essential for success.

Each region offers unique advantages and challenges. High competition increases traffic costs and complicates operations, while focusing on less competitive areas can reduce expenses and improve performance. Evaluating click costs, advertising trends, and user interests is crucial when selecting a region.

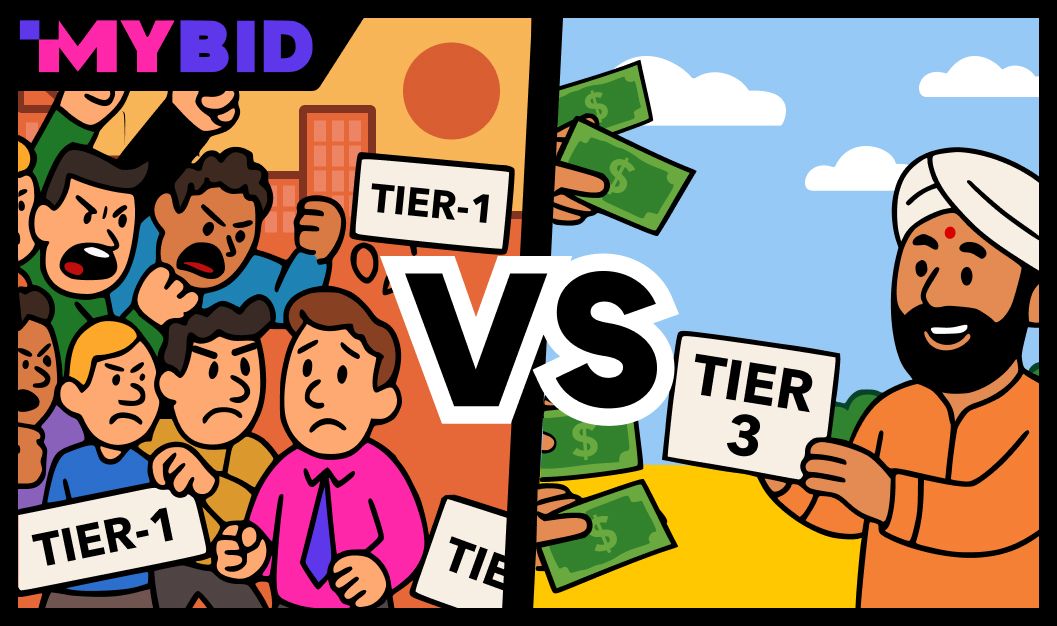

Countries can be grouped into three tiers based on economic development and audience behavior. Tier 1 regions, like the US or UK, have expensive traffic but high profitability. Tier 2 and Tier 3 regions, like Mexico and Bangladesh, are more affordable and ideal for testing new campaigns.

Low-competition GEOs offer significant potential for affiliate marketers. They provide access to receptive audiences and create opportunities to test strategies with fewer risks. This list showcases regions that enable higher earnings with lower expenses, making them ideal for scaling affiliate campaigns.

We offer favorable conditions for advertisers and webmasters on the MyBid platform.

For advertisers:

1. Access to traffic from more than 200 countries, including India, Egypt and Algeria.

2. Quick verification and moderation of\campaigns.

3. Various advertising formats: Push, Popunder, and Video.

4. Protection against low-quality traffic.

5. Round-the-clock support.

For webmasters:

1. 100% fill rate.

2. An intelligent monetization system using artificial intelligence.

3. Safe working with Google and Yandex.

4. Flexible payment terms.

5. Quick payouts.

Start using MyBid today. For advertisers, this is an opportunity to get access to high-quality traffic, and for webmasters — a stable income from the monetization of advertising.

In traffic arbitration, a GEO refers to the geographical location of the audience being targeted by advertising. This parameter is crucial as it influences the profitability and setup of campaigns.

Offer profitability varies significantly from one country to another. For instance, clicks from the US often generate more revenue compared to clicks from lower-income countries.

Language and cultural nuances impact conversion rates. Ads must align with local customs and user behavior to succeed.

Traffic costs and competition levels also differ. Some countries have higher click costs but greater profit potential, while others allow low-budget testing.

Ad platforms may have restrictions for certain regions, especially for niche offers like financial services or health products.

Regions are commonly divided into Tier 1, 2, and 3. Tier 1 includes developed countries like the US, UK, and Canada, offering a highly solvent audience but at high traffic costs. These regions require significant investment and experience.

Tier 2 includes countries with medium economic development, such as Mexico and Turkey. Traffic here is cheaper, and competition is lower, making it a better fit for moderate budgets.

Tier 3 consists of less economically developed regions like Bangladesh and Nigeria. Their audiences are less exposed to advertising, and traffic costs are the lowest. These regions are great for beginners to test ideas with minimal costs and adapt their strategies.

It’s advisable to start with Tier 2 or Tier 3 regions to build skills, analyze audiences, and identify effective methods. Once experienced, you can transition to more competitive Tier 1 markets to attract higher-quality traffic. With a clear approach and consistent analysis, you’ll achieve stable results across any niche.

However, today we focus solely on low-competition GEOs, far from the Tier 1 category.

Choosing a low-competition GEO is an excellent strategy for optimizing ad campaigns and reducing expenses. In these regions, traffic is more affordable, and audiences are often more receptive to fresh offers.

Source of the image: Tripster

In early 2025, Vietnam's population reached 101 million, with an internet penetration rate of 78.8% (79.8 million users). There were 127 million mobile connections (126% of the population), all of which supported broadband (3G/4G/5G). Social networks are actively used by 76.2 million people (75.2% of the population), with Facebook dominating at 95.4% of the internet audience. YouTube reached 62.3 million users, while TikTok had 40.9 million adult users (18+), despite experiencing a 39.7% decline in its audience over the year. Internet speed improved significantly, with mobile internet at 75.72 Mbps (+60.9%) and fixed broadband at 153.99 Mbps (+46.6%).

Key Trends:

Urban population — 40.5%, median age — 33.4 years.

Social networks: Growth in Facebook (+4.8%), but decline in Instagram (-3.2%) and TikTok (-39.7%).

Gender breakdown: Balanced audience on Facebook and YouTube, while 66% of Twitter users are male.

Offline population: 21.5 million people (21.2%) do not use the internet.

Vietnam is ideal for mobile offers due to high internet speed, widespread smartphone usage, and active social media presence among a young and engaged audience. These factors create favorable conditions for testing and scaling mobile applications.

Source of the image: Max Travels

In early 2024, Bangladesh had a population of 173.3 million, with 44.5% internet penetration (77.36 million users). There were 188.6 million mobile connections (108.5% of the population), with internet usage higher in urban areas (40.8% of the population) than rural regions. Internet speed was moderate, with mobile speeds at 23 Mbps and fixed broadband at 39.83 Mbps.

Key Trends:

Urban population — 40.8%, median age — 27.5 years.

Social networks: Facebook leads with 52.9 million users (30.4% of the population), TikTok is growing actively (+48.3% over the year), Instagram has 6.5 million users, and LinkedIn has 8 million users.

Gender breakdown: 65.8% of Facebook users are male.

Offline population: 44.6 million people (25.7%) do not use the internet.

Bangladesh is promising for promoting nutraceuticals due to socio-economic factors such as poverty and limited access to quality healthcare. Products like antiparasitic treatments and health supplements are in high demand. Additionally, the popularity of social media platforms like Facebook enables efficient outreach to audiences and drives demand. Low competition further simplifies the launch of campaigns targeting accessible health solutions.

Source of the image: Culturology

As of early 2025, Mexico's population stood at 131 million, with 83.3% internet penetration (110 million users). Mobile connections reached 127 million (96.5% of the population), with 97.7% broadband-enabled. Social media usage involved 93 million people (70.7% of the population), with YouTube reaching 87.7 million users and TikTok engaging 52.3 million adults (18+). Internet speeds improved significantly, with mobile speeds at 33.10 Mbps (+31.7%) and fixed broadband at 83.00 Mbps (+37.7%).

Key Trends:

Urban population — 82%, median age — 29.6 years.

Social networks: Facebook dominates with 87.6% user coverage, Instagram and TikTok show growth (+12.4% and +12.4%, respectively).

Gender breakdown: Balanced audience on Facebook, 52.9% of TikTok users are male, while 52.8% of YouTube users are female.

Offline population: 21.9 million people.

Mexico is suitable for financial offers and gambling due to an active digital audience, interest in credit products, and convenient online solutions. The widespread use of social media and mobile platforms supports effective engagement through video content, attracting users in both verticals.

Source of the image: Life in Travels

By early 2025, Indonesia's population reached 285 million, with internet penetration at 74.6% (212 million users). Mobile connections totaled 356 million (125% of the population), with 96.4% broadband-enabled (3G/4G/5G). Social networks involved 143 million people (50.2% of the population), with Facebook leading at 95.3% internet audience penetration. YouTube reached 63.2 million users, while TikTok had 45.4 million adult users (18+), despite a 20.5% decline over the year. Internet speeds increased, with mobile speeds at 29.06 Mbps (+18.5%) and fixed broadband at 32.05 Mbps (+13.1%).

Key Trends:

Urban population — 59.5%, median age — 30.4 years.

Social networks: Growth in Facebook (+4.3%), decline in TikTok (-20.5%).

Gender breakdown: Balanced audience on Facebook, 65% of TikTok users are male, and Twitter users are split at 52% male and 48% female.

Offline population: 72.2 million people (25.4%).

Indonesia is perfect for teaser networks due to its large audience actively engaging through mobile devices. Platforms like Facebook provide high involvement, enabling the distribution of visual and interactive ad elements effectively.

Source of the image: Tinkoff Journal

In early 2025, Egypt's population was 126 million, with internet penetration at 85.4% (107.6 million users). Mobile connections amounted to 151 million (119.8% of the population), with 99.2% broadband-enabled (3G/4G/5G). Social networks were used by 108.4 million people (86% of the population), with Facebook dominating at 95.6% of the internet audience. YouTube engaged 90.7 million users, and TikTok involved 54.9 million adults (18+), despite a 21.1% decline in its audience over the year. Internet speeds increased, with mobile speeds at 61.53 Mbps (+42.9%) and fixed broadband at 194.33 Mbps (+50.1%).

Key Trends:

Urban population — 80.6%, median age — 31.9 years.

Social networks: Growth in Facebook (+3.1%), Instagram (+2.7%), and TikTok (+3.8%).

Gender breakdown: 70% of TikTok users are female, 56% of Twitter users are male, and Facebook has a balanced audience.

Offline population: 18.4 million people.

Egypt is promising for promoting nutraceuticals through social media due to the extensive reach of platforms like Facebook and YouTube. A young, urban audience actively seeks accessible health solutions, making social media an effective channel for advertising nutraceutical products.

Source of the image: Lenta.ru

As of early 2025, Colombia's population reached 53.2 million, with 77.3% internet penetration (41.1 million users). Mobile connections totaled 78.3 million (147% of the population), with all connections broadband-enabled (3G/4G/5G). Social networks involved 36.8 million people (69.2% of the population), although specific platforms were not detailed. Internet speeds improved substantially, with mobile speeds at 20.67 Mbps (+68.6%) and fixed broadband at 162.59 Mbps (+45.4%).

Key Trends:

Urban population — 82.8%, median age — 32.5 years.

Social networks: Growth in social media penetration by 1.1%, but without details on platform-specific trends.

Gender breakdown: No data provided.

Offline population: 12.1 million people (22.7%).

Colombia offers great potential for gambling due to high internet activity and interest in online entertainment. Reliable connectivity and increasing audience engagement provide favorable conditions for promoting gaming platforms through digital channels.

Source of the image: Long Bridges

At the beginning of 2025, Thailand's population was 71.6 million, with an internet penetration rate of 91.2% (65.4 million users). There were 99.5 million mobile connections (139% of the population), all of which were broadband-enabled (3G/4G/5G). Social networks were used by 51 million people (71.1% of the population), with Facebook dominating, covering 69.4% of the internet audience. YouTube reached 54.3 million users, while TikTok engaged 38.5 million adults (18+), despite a 16.5% decline in its user base over the year.

Key Trends:

Urban population: 54.7%, median age: 40.6 years.

Social networks: TikTok grew (+13.8%), while YouTube (-7.7%) and Instagram (-3.9%) saw declines.

Gender breakdown: Balanced audience on Facebook and YouTube, while 62.6% of X (Twitter) users are male.

Offline population: 6.28 million people.

Thailand is an ideal platform for mobile applications due to its high internet penetration and a population accustomed to digital solutions. Advanced infrastructure and the popularity of social networks ensure a quality user base for testing and scaling applications.

Using low-competition GEOs is an effective strategy for affiliate marketing, allowing for reduced advertising costs and increased profitability. These regions offer opportunities to test new ideas with minimal risks and engage with untapped audiences.

Their main advantage is access to active yet underexposed users, which drives higher conversion rates. This approach is particularly valuable for beginners and those seeking new growth opportunities in highly competitive niches.